How To Get A Mortgage With No Early Repayment Charge (2023) Up the Gains

Best Mortgages With NO Early Repayment Charge (and How to Avoid them)

A mortgage with no ERC will likely feature additional fees like an admin or arrangement fee that you must pay the provider to sort out the new mortgage for you. Higher Interest Rates. Lenders will likely set higher interest rates for a mortgage with no early repayment charges. It will translate to higher monthly repayments, and you'll pay.

How To Avoid Early Repayment Charges On Mortgages Oportfolio

Understanding mortgage prepayments and charges. Some homeowners find themselves able to pay off their mortgage early, or they wish to break their current mortgage. However it's not always easy to make sense of a mortgage provider's prepayment charges. Since we understand that being mortgage-free is an important goal for many of our clients.

Can you get a Mortgage with no Early Repayment Charge?

An early repayment charge is often 5 - 1% of the remaining mortgage depending on your mortgage agreement with your current mortgage lender. Generally, ERCs are calculated based on how much longer your current fixed-rate mortgage has left until completion; thus, if you are close to finishing off a 2-year term then the fee may be higher than with one that runs for an extended timeframe.

DITCH THE FIXED RATE MORTGAGE paying your early repayment charge YouTube

Yes, it is possible to secure a mortgage with no early repayment charge. Securing a mortgage-free from an early repayment charge is achievable with the right approach and guidance. An experienced mortgage broker is your best ally in identifying these not so easy to find mortgages. However, before jumping at a no-ERC mortgage, it's wise to.

Can you get a Mortgage with no Early Repayment Charge?

Finally, multiply the number by 6 to get the fee of 6 months' interest. The equation should look like this: $200,000 .05 = $10,000. $10,000 ÷ 12 months = $833.33. $833.33 6 months' penalty amount = about a $5,000 penalty. Fixed amount: You would pay whatever the stated fixed amount is, such as $3,000. Sliding scale based on mortgage length.

Mortgages with No Early Repayment Charge YesCanDo Money

The accelerated payment option allows you to make half-payments (so in the case of our example, $750) every two weeks. One full year can be broken up into 26 two-week periods; this means you'll make 26 $750 mortgage payments in one year which equals $19,500. There you go, you can accelerate your mortgage payments by $1500 every year and you.

How to get a mortgage with no early repayment charge (ERC) Nuts About Money

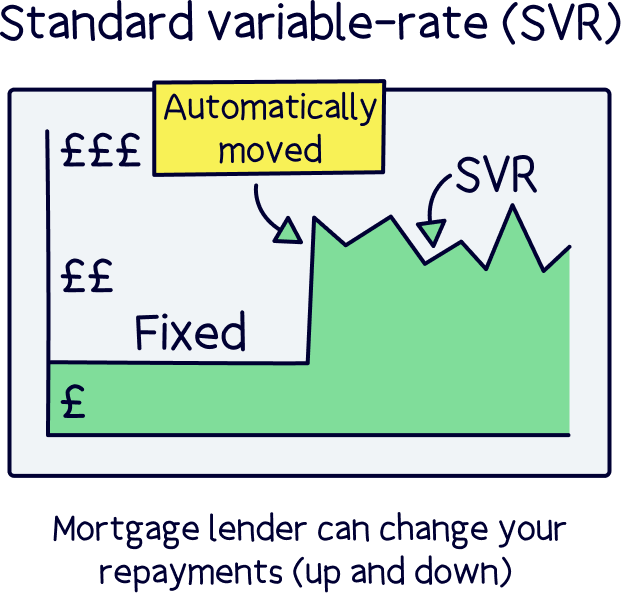

While no early repayment charge mortgages offer greater flexibility in making payments, overpayments, and early payouts, they come with drawbacks, like potentially higher interest rates or limited product availability. Here's a quick breakdown of all the different types of mortgages with no ERCs you may find on today's market.

Buy to let mortgage with no early repayment Charge

If you repay your mortgage early, you may have to pay an early repayment charge (ERC). An ERC is a fee that is charged by your lender if you repay your mortgage early. The amount of the early repayment fee will vary depending on the lender and the terms of your mortgage. In some cases, the ERC can be very high, so it is important to be aware of.

Should I Remortgage if I have Early Repayment Charges on my Mortgage?

An early repayment charge, also known as an ERC, is a fee for paying your mortgage back early. When you get a mortgage, you'll normally sign up for a deal that lasts a set amount of time. For example, you might get a fixed-rate mortgage, which is where your monthly repayments are set at a fixed cost each month, often for 2, 3 or 5 years.

Best Mortgages With NO Early Repayment Charge (and How to Avoid them)

Mortgage prepayment penalties and privileges. A prepayment penalty is a fee that your mortgage lender may charge you if you: Your lender may also call the prepayment penalty a prepayment charge or breakage cost. If you have an open mortgage, you can make extra payments without paying a penalty. If you have a closed mortgage, there's a limit.

5 Year Fixed Buy to Let Mortgage with no early repayment charge YouTube

An early repayment charge is usually between 1% and 5% of what you still owe on your mortgage agreement. You might be able to pay less if you have been with your lender a long time, but this is up to the lender. You can choose to pay your early repayment charge in one lump sum. This might make sense if the charge is lower than the amount of.

Mortgages With No Early Repayment Charges » Mortgage » Home

Remortgage your home with a new lender during the term of your current mortgage deal. Have to terminate the deal and sell your home. Sometimes referred to as 'redemption charges' or 'redemption fees', ERCs are typically charged as a percentage of the value of loan you are yet to repay, usually at a rate of between around 1 and 5%.

What is an Early Repayment Charge (ERC)? Blossomfield Mortgages

(19).png)

How much does an early repayment charge cost? The cost of an ERC is based on the outstanding mortgage amount and the point at which you are in your deal. Typically, ERCs range from 1% to 5% of the remaining loan, and this percentage tends to decrease each year you're into the deal. For example, a £200,000 mortgage could cost you £10,000 in.

Best Mortgages With NO Early Repayment Charge (and How to Avoid them) Interest Rate News

That said, for the right borrowers, fixed rate mortgages with no early repayment charges do exist, such as with Godiva and Leeds Building Society. Buy-to-let mortgages: Because of the nature of the way landlords work (buying and selling properties), demand is high for no ERC products.

Best Mortgages With NO Early Repayment Charge (and How to Avoid them) Interest Rate News

Penalty Fees. If you pay off your mortgage early, you may be subject to early repayment penalty fees, which can be substantial depending on your exact situation. Again, you will need to review your mortgage contract to find out what the early prepayment penalty fee is, or if there is one at all. Professional Fees

How To Get A Mortgage With No Early Repayment Charge (2023) Up the Gains

Prepayment Mortgage Penalties in Canada. When you pay off your mortgage early, either in part or in full, you may have to pay a prepayment penalty. This helps the lender recover the money you would have paid them in interest if you had continued on the agreed payment schedule. These penalties can be very expensive, potentially costing thousands.